THE TANZANIA ASSOCIATION OF MICROFINANCE INSTITUTIONS

Introduction

Tanzania Association of Micro finance Institutions (TAMFI) is a not-for-profit umbrella organization for micro finance institutions in Tanzania. It was formally registered in 2001 as a sole network for micro finance activities in the country. Members include Commercial, Community and Microfinance Banks, NGOs, Private MFIs, SACCOS, apex of informal groups, micro -insurance company and Business Service Providers. The association seeks to develop capability of micro finance institutions and the micro finance sector in general through advocacy, lobbying, research and development, responsible micro finance, capacity building, and information gathering and dissemination. The National Micro finance Policy also assigns the task of developing and ensuring application of standards to the network.

Furthermore, the Association promotes and encourages the establishment of new products and related markets and organizes forums and meetings in order to promote communication among members, to strengthen their relationship and to transfer information and experience among them. TAMFI encourages networking which is an integral part of any association. In this regard, the Annual General Meetings attracts a growing number of attendees each year and make it an event where discussions are held on important and emerging issues and time is taken to learn more.

The current over 160 member institutions of TAMFI reach out to approximately 1.2 million micro entrepreneurs in urban and rural areas. These are micro entrepreneurs who are committed to change their financial behaviours. Microfinance institutions are providing a broad range of financial services to these poor and low income people who are systematically excluded from formal financial system. Financial services include credit, savings, leasing, insurance, mobile/wire transfers, housing and pensions. And as a result these active poor communities are included in the mainstream financial system. Furthermore, they are financially educated and exposed.

TAMFI’s power is derived from its constitution, which is registered by the Registrar of Societies as a Non Profit and Non-Governmental Organization.

(2) Members

TAMFI is a member based organization. The mandate is established and reviewed by Members of the association at Annual General Meetings (AGMs). The Association members are categorized under article 4 of its constitution, as ordinary members comprised of MFIs legally registered in Tanzania and the second category is that of associated members.

(a) General (Ordinary) Members

The following are the ordinary members:

MFIs legally registered in Tanzania

Directly involved in the provision of savings and credit instruments to micro and small enterprises for business purposes

Have in its objectives, the provision of savings and credit to small businesses

(b) Associate Members

Organizations or institutions which, though not directly involved in the provision of micro-finance, are involved in micro-finance as donors, direct providers of products/services to MFIs, which directly facilitate micro-finance activities such as Loan Guarantee funds and direct providers of technical assistance to MFIs.

(3) Goals and Objectives

The prime objective of the TAMFI according to Article 2 of the Constitution of the association is: “To facilitate (develop) the capability of Micro-finance Institutions (MFIs) and the micro-finance sector in Tanzania through lobbying, advocacy, training and information gathering and dissemination”

The objectives of TAMFI are:

To enhance, strengthen, and to act as a forum to address mutual interests and to develop micro-finance institutions in Tanzania.

To act as a networking, lobbying and advocacy body for the sector.

To act as a unifying organ between its members.

TAMFI shall advocate the Government of Tanzania (GOT) to create and maintain an appropriate regulatory framework for Micro-finance Institutions in Tanzania.

To facilitate (carry out) research relevant for MFI development and provide viable suggestions.

(4) Strategic direction

Based on the goals, objectives and functions of the association, the strategic direction of TAMFI has been formulated and presented in the form of vision and mission statements and core values. These form a framework upon which the business of the association is built.

VISION

TAMFI’s vision is to “become a vibrant network that effectively supports the MF industry in Tanzania.”

MISSION STATEMENT

TAMFI’s mission is to “facilitate creation of an enabling environment for development of a sustainable microfinance industry in Tanzania through participation of all stakeholders.”

CORE VALUES

TAMFI’s core values should guide code of conduct of its staff and its members as follows:

Accountability and transparency

Equity, fairness, and equality in the treatment of members

Adherence to microfinance best practices

Non-discriminatory services

Good governance

Political independence

Supporting environment-friendly enterprises

(5) Where is TAMFI now and what are its aims?

Membership is purposely open to a wide variety of market participants to assure broad perspectives in the participation and as a result banks, microfinance institutions, informal groups, SACCOS, Insurance and Service Providers and as well as other participants in the industry have joined and support TAMFI. Clearly TAMFI wants to expand its membership by growing nationally across the country and establish itself further as a National Microfinance Association.

A clear milestone in the history of TAMFI is the influence the Association has had on advocating for a favorable legal and regulatory framework for microfinance institutions. Existing members of TAMFI played a considerable role in reviewing the National Microfinance Policy of year 2000. TAMFI members believe that a reviewed microfinance policy will take into account new developments, current needs and existing challenges in accelerating provision of diversified, inclusive financial services on a sustainable basis. Nevertheless, TAMFI is fully determined to see a Microfinance Act in place which will enable microfinance institutions to operate competitively and profitably.

The Association has brought forth a code of conduct that is emphasizing on fair and responsible practices to borrowers, disclosure, lending practices, collection practices, institutional transparency and human resource ethics. In adhering to the code of conduct clients are protected against malpractices.

(6) Board of Directors

As portrayed below, the Association has high profile, highly respectable and highly experienced and committed Board of Directors drawn from the microfinance industry. These include:-

(i) Mrs. Devotha Ntuke Minzi – Chairperson (Representing Tier 2)

Mrs Devotha Minzi is an economist, entrepreneur, a trainer and a leader who founded a microfinance institution called K-Finance after retirement as a Central Bank Senior Officer. She is currently serving as a Board chairperson of K-Finance which has its head office in Dar-es-Salaam, and a branch office in Dodoma region. Mrs Minzi is also the founder and board chair of K-Finance Insurance Brokers (KIB) LTD, established in 2019, a subsidiary of K-Finance Microfinance Institution.

Minzi is actively engaged in a Financial Education program which she started in 2019. The financial education program is known as Ignite Business Clinic (IBC) and the program mostly targets women and youth. The objective of IBC is to provide economic empowerment and financial freedom by providing entrepreneurship and business soft skills. It is Madame Minzi’s vision that with the right mind set and accountability people can achieve financial freedom. Ms Devota Minzi holds a Bachelor of Statistics from University of Dar es Salaam and a Masters of Arts in Economics.

(ii)Mr Juma Maabad Ahmedi – Vice Chairperson (Representing Zanzibar Cluster)

Mr Juma Maabad Ahmed has vast experience in fund management, credit management, and entrepreneurship. He has worked with Zanzibar Economic Empowerment Agency for 10 years and he is currently serving as a head coordinator of financial institutions. He is a competent Trainer of trainees and has conducted a number of trainings on entrepreneurship and related subjects. Mr Juma received training on portfolio and risk management and small-scale entrepreneurs in Noida, India. He holds a Bachelor degree in Economics from Zanzibar University.

(iii) Mr Bartholomew Kway – Board member (Representing Tier 2)

Mr Bartholomew has over 10 years of practical experience in Microfinance as a practitioner and consultant. Bartholomew is a Partner at BK Associates and Managing Director of BK Finance Limited. He has wealth of experience in Microfinance, Financial management, financial accounting, audit and reporting obtained through working with various entities such as Manufacturing, trading, telecommunication, service organizations and an International NGO. He holds a Master degree in Business Administration (MBA) from University of Dar Es Salaam. He is a Fellow Certified Public Accountant in Public Practice (FCPA). He also holds Bachelor of Laws degree (LLB) from the Open University of Tanzania and Advanced Diploma in Accountancy from the Institute of Finance Management (IFM). He is a Fellow member of the National Board of Accountants and Auditors of Tanzania (NBAA). Bartholomew is a Professional Coach who graduated from International Coach Federation (ICF), Accredited Coach Training Program (ACTP). As a coach, his interest is to help youth to realize their full potentials.

(iv) Mr Lawrence Muze – Board Member (Representing Tier 3)

Mr Lawrence Muze is the current Chairperson of Mtoni Lutheran Church Dar es Salaam and General Manager of Kwanza Collection Company. He has been in the arts and crafts business for the past 36 years working at different capacities; from Accounts Assistant to Finance Officer. Muze has also been a Vice Chairperson and Chairperson of WFTO Africa and Middle East between years 2011 and 2014. Since year 2006, Muze is the Treasurer of Tanzania Network for Fair Trade (TANFAT) and as well as Treasurer of African Evangelist Enterprises since 1996. He has travelled widely to Europe, USA, parts of Arica and within Tanzania to participate in Trade Fairs. He holds a Diploma on Business management and has attended Business Development trainings in Kenya and Swaziland.

(v) Ms Veronica Liombo – Board Member (Representing Tier 4, CMGs)

Ms. Veronica Liombo has over 7 years of wide experience in Community Microfinance Groups. Veronica is currently the Executive Director for an organization called Opportunity for Social and Economic Progressive (OSEPO). She used to be a technical implementing partner of Dar es salaam Youth Economic Empowerment (DYEE) through the Basic Employability Skills Training (BEST) Model under Plan International Tanzania and National Bank of Commerce (NBC). She also worked in connecting savings groups with an app termed as CHOMOKA for saving data under Care International. Veronica holds a Diploma in Marketing Management (Marketing Management) from the Collage of Business Education of Dodoma (CBE).

(vi) Ms. Irene Mdachi – Board Member (Representing Business Development Service Providers)

Ms. Irene Mdachi, has over 15 years of working experience, with 8 years of practical experience in IT project management with focus on Software as a Service Platforms/software’s. She is currently working for a project that aims at enhancing financial inclusion for all in Tanzania through the adoption of digital banking channels. Irene has managed the development of Omni communication channel, Data collection Applications (iOS & Android), Data analytics dashboard and reporting tools. She has assisted the rolling out and implementation of digital banking channels both Mobile Application and web application in Tanzania. With the assistance of technology experts from India we are building an affordable core banking system and loan management platform that will target microfinance Institutions and SACCOS in Tanzania. Ms Irene is currently the country representative of Bankingly, Business Manager for Oneflet and Partner at GetCore. I have taken part in several research programs in examining factors hindering Financial Inclusion in Tanzania. She is training MFI’s in Tanzania the importance of opting SAAS platforms and its advantages for small, growing institutions. Ms Mdachi holds a Bachelor of Banking and Finance from the institute of Finance Management (IFM) and Master’s degree in Business Administration from the Eastern and Southern Africa Management Institute (ESAMI).

(Vii) Mr.Jovin Ndungi – Lawyer (Independent Representative)

Mr.Jovin Ndungi, is a seasoned legal practitioner in banking and finance, Microfinance, taxation and corporate and commercial law practice for about 16 years. He has worked both as in-house counsel and corporate counsel in the banking sector and private legal practice. He is a trainer of corporate governance and compliance, credit and collateral management and enforcement to microfinance practitioners and has been very much involved in credit recovery and collateral enforcement in the country. He is one of the resourceful personnel in microfinance regulatory reforms and compliance having played key role in capacity building of microfinance players. Jovin holds a Bachelor of laws degree -LLB.

(7) Employees

Currently the Association has six staff members;

(i) Ms Winnie Terry, (Chief Executive Officer)

Ms Winnie Terry main functions are to run and oversee day to day activities of the association. She has almost 12 years experience of Microfinance matters while working with FINCA Tanzania and Tujijenge Tanzania at different capacities. She has attended numerous short courses on microfinance, management and leadership locally and internationally. Winnie holds a Bachelor Degree from University of Dar es Salaam and a Masters Degree in International Development (Economic Policy) from University of Ohio, USA.

(ii) Deodati Bernard, Program officer (Renewable Energy)

Mr. Deodati has remarkable skills and experience on developing and managing social and business-related projects. He has more than 12 years in the field with high interests on enterprises development, financial analysis and BDS support. Mr. Deodati has been working with various interventions in solving agriculture SMEs and smallholder farmers access to finance, business capacity building and market linkages. He is a key program person in renewable energy financing for the MFIs since 2021; an initiative by TAMFI under MOTT Foundation. Other initiatives include; UN Joint programme on Youth Employment and Employability served as National Programme Coordinator (2015-2017) to link Enterprises with pool of skills from the University graduates. Mr Deodati was hired to conduct Monitoring of the ILO Youth Employment projects for the funds allocated to Youth SACCOS in Kigoma region. The expert was engaged as a project manager in 2018-2021 linking farmers to access finance and markets in the Southern Highlands of Tanzania. In 2020/21 Mr. Deodati conducted a survey (under the AGRA funded project) to assess factors that constrain smallholder farmers to access financing from formal financial institutions in the Southern Highland regions of Tanzania. Mr Deodati is a Master ‘s holder in International Business of the University of Dar es Salaam.

(iii) Ms. Judith Sando, Program Officer (Water Supply and Sanitation)

Ms. Judith Sando is an expert in Women Economic Empowerment and Social Advancement with experience stretching over two decades. She is currently part of the Tanzania Association of Microfinance Institutions (TAMFI) Secretariat as the Program Lead for the WaterCredit Adoption (WCAD) Program. She has a rich background in microfinance commencing in 2000 where she has worked in several capacities ranging from loan officer to senior management and executive levels. Judith is an Internationally Certified Microfinance Expert from the Frankfurt School of Finance and Management and holds a Bachelor of Science in Agriculture from the University of Eastern Africa, Baraton and a Master’s in Business Administration from Maastricht School of Management. She is also associated with networks that engage in the social advancement of women such as: Housing Microfinance Working Group (HMFWG), Women in Law and Development (WiLDAF), Tanzania Gender Network Platform (TGNP), CSO Women Directors Forum (CWDF) and Policy Forum. Judith is also passionate in engaging with the youth and does so through forums, dialogues and out-door activitie

(iv) Clemence Mulabwa (Accounts Assistant & Program Officer)

Mr. Clemence Mulabwa has been an Accountant for the Association for the past seven (3) Years. He is responsible in financial management of association and project activities. He is also accountable in collecting reports from members and compilation including mobilization of members. Clemence holds a Bachelor of Accounting and Transport Finance from National Institute of Transport (NIT)

(V) Georgina Masamu, Assistant Program Officer- Water Supply and Sanitation

Ms. Georgina Masamu joined our association in February 2023 as an Assistant program officer for Water Credit Adoption (WCAD) Program. Georgina has been working in the Microfinance, Water and Sanitation industry for the past four years. At TAMFI she is responsible for supporting all areas of the program together with capacity building and collecting reports from members under WCAD Program, just to mention a few. Georgina holds a Bachelor of Arts with Education from Jordan University College.

(Vi)Mercy Rehani (Administrative Assistant)

Miss Mercy Rehani, has been the administrative assistant of the association for 15 years. Mercy is responsible for the entire administration of the Association’s activities. She is responsible in maintaining communication between the secretariat and members, including contacting and coordinating members to attend meetings and trainings provided by the Association. Follow up on subscription fees on time, and ensuring a safe environment for employees in the office and the cleanliness of the office. Mercy has a certificate in secretarial and a Bachelor degree in Environmental Management from the Open University of Tanzania.

Support

Currently the Association is solely depending on its Members subscriptions and funding from various institutions including Financial Sector Deepening Trust (FSDT), Marketing, Infrastructure, Value Addition and Rural Finance (MIVARF), and BEST-Dialogue. Other partners include Savings Bank for International Cooperation (SBFIC), SELF Microfinance, CITI Foundation and Oikocredit.

Benefits of being a member

- An opportunity to collaborate and network with various local and international microfinance players.

- A platform for lobbying and advocacy on issues affecting microfinance sector.

- Networking – sharing of the industry’s information/trends, knowledge, market intelligence.

- Be seen/trusted/respected microfinance player – all member institutions adhere to code of conduct

- An opportunity to advertise through TAMFI website, newsletters, forums and through TAMFI international partners such as SEEP Network, AFRACA etc.

- An opportunity to receive capacity building skills trainings organized by TAMFI or TAMFI partners at a subsidized cost.

- An opportunity to receive both local and international technical support from TAMFI technical partners at a subsidized cost.

- An opportunity to participate in local and international events through TAMFI support.

- Linked with national and/or international partners

- An opportunity of being assisted to raise resources through TAMFI channels.

- Participation in TAMFIs activities such as Annual Microfinance Forums, CEOs roundtables, and trade fairs.

- Be involved in microfinance research in the country and outside.

- Data sharing including the MIX Market.

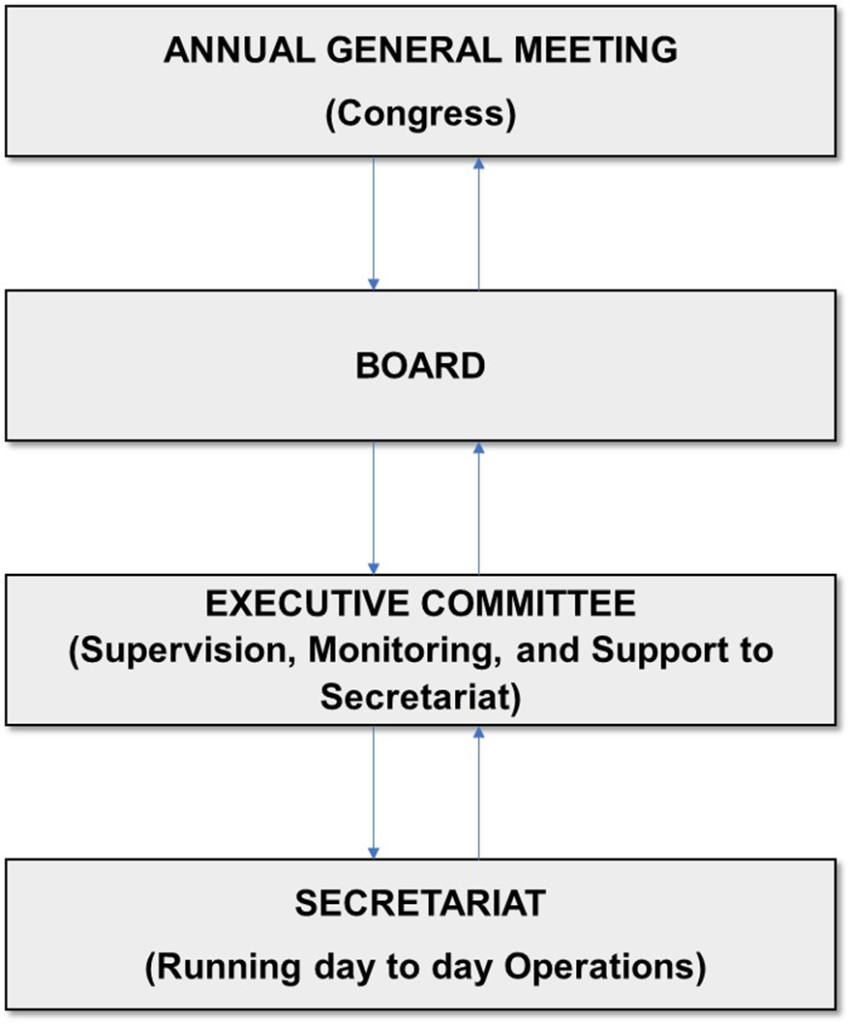

(10) Organization structure

How to contact TAMFI

For more information on TAMFI, its members and how to join membership, please email: info@tamfi.co.tz Mobile: +255 764 668 331 or visit website: www.tamfi.com